We already discussed in the previous blog, Top Reasons Why You Need Emergency Money, why having an urgent fund is important, so you probably know that this should be one of your financial priorities, right? Chances are, you’re probably even considering starting now. However, do you know how?

If you have no idea how to start, here are the simple steps you have to take.

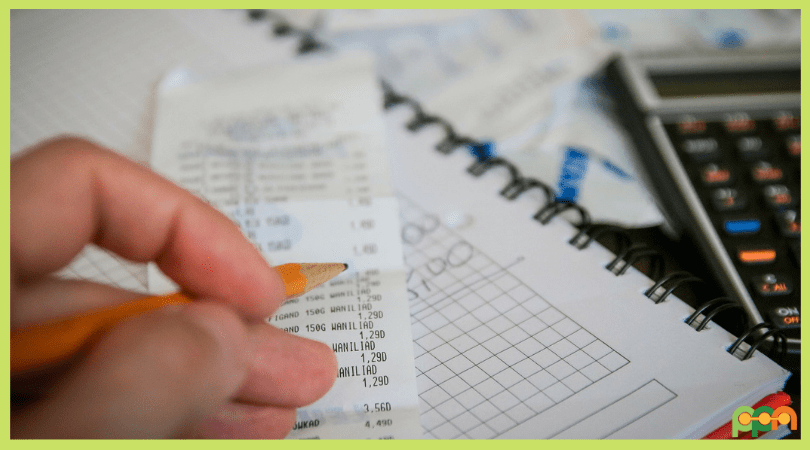

Review Your Income and Fixed Expenses Then Calculate

Ideally, we need to think about taking our savings first from our gross income before planning how to delegate the rest for our expenses. However, in the practice of planning, this is impossible to do, especially if you have no idea what your future expenditures are.

For you to effectively plan your budget, know first all of your expenses. It’s better if you put all of your notes in an affordable mini-sized memo notebook that’s portable enough for you to keep in small spaces or bring anywhere. Although you can usually put notes in your phone, tablet, laptop, or computer, these devices might get broken or might run out of battery when in need, so try not to depend on them all the time.

Also, if you’re always on the move and has a lot to do, writing it on paper or notebook will be your wisest choice. Besides, how much space and weight can a small notebook occupy, right? It’s not expensive and it’s useful for many other things, so it’s a good investment.

Create a Budget

Determine the exact amount you will be saving for emergency use alone. Then, know in what ways will you be keeping this money. Will you store this in a savings account or will you keep it in cash?

If you choose to save money through an ATM Savings account, that’s a good choice because the temptation of having cash nearby will not haunt you into spending it. However, when disasters or any emergencies happen, will you be able to withdraw the amount immediately?

If we get back to the blog, How to be Financially Sustainable After a Disaster Strikes, it was emphasized how important having cash at hand is in case of emergencies. Note that during these tough times, there’s a fat chance that debit cards or credit cards won’t be functional. That’s why if you’re saving emergency money, it’s best if you keep cash or coins.

Keep Your Money in a Safe Place

The word “safe” is relative here. This is why it’s important that you analyze first the dangers you or your money could face. You need to discover the weaknesses to know how you could give your saving its strengths.

If a case of fire or flood might ruin your precious emergency fund, you can put it in a waterproof envelope that’s made just for a cash envelope money saving system, or you can check out Ways to Keep Your Money Disaster-Proof for more interesting ways. However, if the problem’s just you overspending it, that’s another story.

Whether it’s cash or coins, store it in a place that’s accessible to you but not to the different dangers around you, like theft, fires, floods, or any kind of mayhem.

Next time you’ll have some spare change lying around, a work bonus, or a lottery prize, remember to save a portion of it for your future’s unplanned events. At all times, keep yourself worry-free by avoiding all kinds of unexpected mishaps ruin your life’s most treasured moments. Prepare for the worst and enjoy all the bests.

Be positively practical and have a wonderful day!